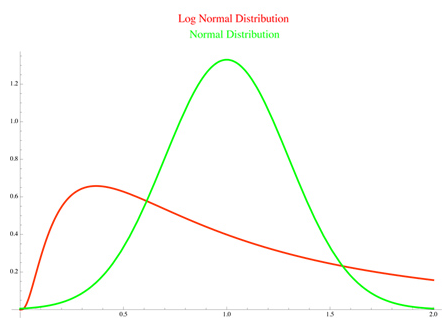

A normal distribution is often referred to as a Bell Curve. Your model’s average return is exactly in the middle of the distribution, and you are equally likely to have a return on either side of the distribution.

A lognormal distribution is a little bit more involved. From a technical standpoint, the logarithm of your model’s returns will form a normal curve. This means that you are more likely to get returns below your average return – however, your below average returns will not be as extreme, and you are more likely to get returns significantly above your average return.

Both the Normal and Log Normal distributions are simplifying assumptions. Neither distribution is inherently better than the other. Both distributions do a reasonable job of of describing investment returns in the context of Monte Carlo analysis. Deciding between the two distributions is really about what assumptions you are making, and which distribution makes you (and your clients) feel more comfortable.

For more information, a good place to start is the Wikipedia article on Log-normal Distributions.

Comments